War, Sanctions, and Inflation: What is in store for Russia’s Economic Future?

As economic sanctions pile up against Russia, President Vladimir Putin remains steadfast in his decision to wage war in Ukraine.

At the five-week mark of the Russian invasion of Ukraine, at least 23,000 are dead, 1,900 are injured, and ten million are displaced. These statistics, although horrific, cannot completely capture the toil that the Ukrainians have been feeling on a daily basis. To best serve his people, Ukrainian President Vladimir Zelensky pleaded for the help of NATO countries to end Russian aggression as quickly as possible. Because deploying troops or aircrafts would likely be taken as a declaration of World War III by Putin, President Biden and other global leaders are employing a more distant method to wear down Russia’s offense: economic sanctions.

Economic sanctions are not a method unique to modern diplomacy. Yes, we have seen this practice applied most frequently in the 20th century, but the first recorded use of sanctions was actually in 432 B.C. when the Athenian Empire banned traders from Megara from its marketplaces. While economic sanctions have been used across centuries and have varied in size, shape, and form, their motive has largely remained the same: to “strangle” a rival economy until they are forced to surrender their pursuit.

In the context of the ongoing Russo-Ukrainian War, blocking Russian imports and transactions, would, in theory, collapse the Russian economy until they cannot bear to pay the costly price of war. European Union President Ursula von der Leyen hopes that the sanctions eventually “stop Russia from using its war chest.”

Since Putin invaded Ukraine on February 23, more than 30 countries swiftly responded with sanctions on Russian banks, airlines, companies, oil imports, media, ships, entities, and oligarchs. Notable efforts include the United States, the European Union, the United Kingdom, and Canada announced on February 26 that selected Russian banks were removed from the SWIFT messaging system. This measure aims to freeze certain parts of the Russian economy and isolate Russia from international trade because SWIFT facilitates financial transactions between global banks. Switzerland even broke its historic neutrality after freezing the assets of 122 Belarusian and Russian officials and imposing trade restrictions on some Russian companies in the energy sector.

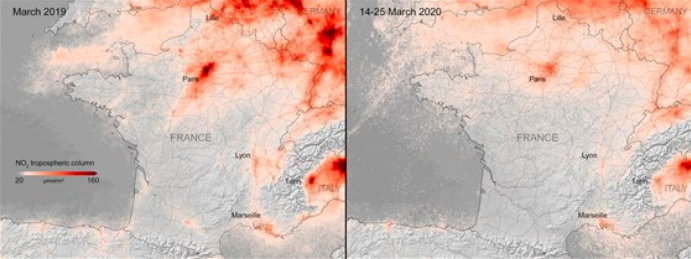

As of now, quantitative data shows that sanctions are staging a dark cloud over Russia’s economic future. The value of the ruble plummeted to just 0.0077 of one US dollar on March 7, signaling immense inflation on Russia’s horizon. Economists at the Russian Central Bank predict that inflation will grow by 20% and GDP will fall by 8% this year.

While economists’ projections differ on the extent and rate of economic deterioration, more than 90% of panelists in a conference of US and EU university economists agreed with the statement that “the economic and financial sanctions already implemented will lead to a deep recession in Russia.” Professor Karl Whelan at University College Dublin strongly affirms this statement by saying, “Russia runs a large non-energy current account deficit. Loss of access to supplies and services will hurt the economy.” Stanford economist Kenneth Judd responds: “Yes, IF we maintain them. We cannot retreat. We must maintain this united squeeze on Putin.” Others, like Princeton economist Markus Brunnermeier, take a more conservative stance by asserting that Russian growth rates were already low before the invasion and that the effects of sanctions will only be seen with time.

While Putin’s cronies and corrupt Russian oligarchs will likely remain relatively unscathed, these economic sanctions will hit common Russians the hardest. Russians, in fear of their inability to pay with credit or make online transactions, have liquidated their assets and withdrew almost a trillion rubles from banks after the SWIFT sanctions. Rising inflation rates and the threat of lower purchasing power in the future are incentivizing mobs of Russians to stock up and buy out stores. Many are also fleeing the country.

A YouTube video titled “What do Russians Think Now? 3 Weeks After the Start” by the channel “1420” also provides a glimpse into the otherwise highly censored opinions of ordinary Russians. While some Russians are products of Russia’s intense propaganda, remaining ignorant to the reality of the “special operation,” others have bravely voiced their criticisms against their corrupt government. One woman lamented that she had recently been laid off, while another expressed concern over her mother’s businesses, where prices have risen by 30%. Even the prices of everyday goods, such as the popular refreshment kvass, have increased. One individual even called the war “disgusting,” and blamed Putin for worsening the lives of all Russians.

While we can observe the short-term consequences of the current sanctions, it is much harder to agree on what these will evolve into in the long run. As of now, the piling of global sanctions against Russia is not deterring Putin from continuing the war against Ukraine. Amidst the economic strain induced by the sanctions, Putin’s unabashed campaign of destruction demonstrates not only his disregard for the Ukrainians, but also for his own people. Instead of prioritizing the well-being of his citizens and staying true to the United Nation’s vision of international peace, Putin remains delusional in his fantasy to resurrect the “glory” of the former Soviet Union. His indifference to global disdain and isolation illustrate his monomaniacal nature, which surpasses reason and borders insanity. On what occasion, if any, will Putin stop this madness?

*For a more in-depth look at the sanctions imposed against Russia, see here.

When not writing or editing for GAP, Sarina is watching figure skating re-runs, testing daunting recipes, or playing with her dog, Milo. She also loves...